Cloud computing market is no longer a trend or a niche subject. Cloud seems to be here to stay and is slowly becoming the new playing field, shaping up industries as it grows and forcing them to adapt.

In a series of articles we’ll investigate how the cloud computing market is segmented, its growth rate and also what this whirlwind evolution means for service providers that focus on SMBs.

Cloud computing, defined as a style of computing in which scalable and elastic IT-enabled capabilities are delivered as a service using Internet technologies, is typically segmented into:

- Infrastructure as a Service (IaaS) – The simplest of cloud offerings, IaaS takes the traditional physical computer hardware, such as servers and networking, and lets you build virtual infrastructure that mimics these resources. The difference is that these resources can be created, reconfigured, resized in minutes. The benefit is that there are few limitations imposed on the consumer.

- Platform as a Service (PaaS) – Operating at the layer above raw computing hardware, PaaS emerged from the less than perfect nature of IaaS for cloud computing and the evolution of web applications. Typically, applications must be written for a specific PaaS offering to take full advantage of the service, and most platforms only support a limited set of programming languages. Often, PaaS providers also have a Software as a Service offering and the platform has been initially built to support that specific software.

- Software as a Service (SaaS) – The top layer of cloud computing, Software as a Service is typically built on top of a PaaS solution, whether that platform is public or not, and provides software for end-users such as CRM, payroll, accounting or business communication services. SaaS has a pay per user business model and companies are free to scale up or down as they see fit and only pay for what they use, on a monthly basis.

This first article deals with IaaS market evolution.

IaaS Market Trends

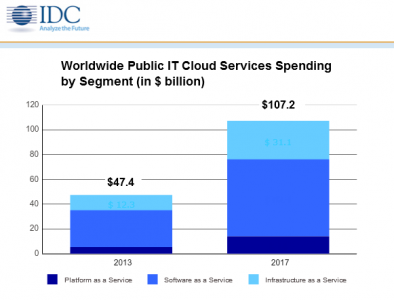

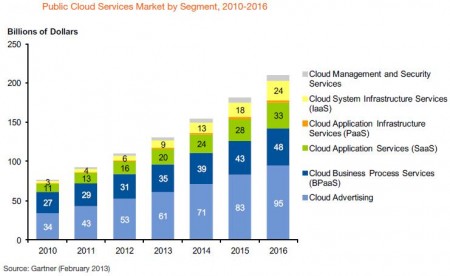

IaaS will be the second fastest growing cloud computing segment, surpasses only by PaaS. The growth rate is expected to be anywhere between 27% to 43% CAGR through 2016, depending on the analyst source.

One of the reasons for this growth is, according to Frank Gens, Senior Vice President and Chief Analyst at IDC, the shift from improving the efficiency of the IT department towards innovation:”Over the next several years, the primary driver for cloud adoption will shift from economics to innovation as leading-edge companies invest in cloud services as the foundation for new competitive offerings. The emergence of cloud as the core for new ‘business as a service’ offerings will accelerate cloud adoption and dramatically raise the cloud model’s strategic value beyond CIOs to CXOs of all types.”

Another reason for this accelerated growth is the growing traction of cloud computing among enterprises that have an increased spending at the IaaS level. This comes from enterprises looking at how to integrate legacy ERP or CRM systems with cloud platforms. Gartner predicts that IaaS spending will reach US $24 billion by 2016.

Note: Gartner has a slightly different cloud computing market segmentation, adding besides IaaS, PaaS and SaaS, Cloud Advertising, Cloud Management and Security and Cloud Business Process Services.

But how exactly is this market set to grow and what does this growth mean for service providers?

- For once, the IaaS is not yet a commoditized market. There are many competitors and many newcomers launching cloud services to target the markets that they already serve. Yet, their offerings have limited differentiation and little extra value besides the ability to provision resources quickly. So one of the trends of the IaaS market will be fierce competition.

- Lacking differentiation or at least, given the relative difficulty of customers to assess the perceived differences of the offerings, the market will turn to consolidation. Many of the smaller players will be gobbled up by larger players.

- And that will also happen because IaaS is a market where scale brings disproportional advantages to the largest player. Software generally requires a large upfront investment, but each new customer adds little cost, and software markets tend to become “winner-takes-it-all” arenas, where a small number of vendors command dominant market share. Additionally, customers’ expectations are increasing and many competitors don’t have the resources to serve the entire array of market needs. So, we’ll probably see a few large, diversified players with big ecosystems and a few small, specialized ones, typically on vertical clouds such as healthcare.

- Another market trend, stemming from the limited differentiation but also from customers’ preferring managed services over self-service, will be the incumbents diversifying into more sophisticated services including PaaS and SaaS. Already, the largest PaaS providers are those that first made their mark on the IaaS market, such as Google App Engine or Microsoft Azure.

All these market shifts will make it pretty hard for smaller service providers to have room of maneuver in the IaaS market. Moreover, enterprises that are large enough, access IaaS on their own, not needing intermediaries. So service providers are left to serve the SMB market.

The SMB market presents some challenges of its own such as lack of technical expertise, meaning that services providers will have to adapt their business model on several levels:

- They need to offer some form of managed services to make up for the lack of internal expertise on the SMB side.

- They need to learn to sell consultative as opposed to selling off-the-shelf, since SMBs are not yet educated on cloud computing and they might need some hand holding along the way.

- Finally, to make up for the extra effort involved in selling to SMBs, service providers will have to offer additional value-added services that add up to higher margins.

One thing is certain: the IaaS providers are here to stay and in the long run they’ll get fewer, but bigger. Smaller service providers that don’t have their own cloud infrastructure can work with one of these players, but they’ll need a comprehensive cloud strategy and probably a revised business model to serve the cloud-ready SMB market.

Post A Reply