The banking sector has been through a lot for the past 6 years. Starting with the 2008 financial meltdown and continuing with a perpetual lack of customer trust, the banking industry seemed to be on a continuous downward spiral.

Yet, there are signs that banks have finally learned their lessons and have managed to turnaround consumers’ confidence. The 2014 Ernst & Young Global Consumer Banking Survey shows that consumer confidence in banks has risen 50% versus previous year. The report goes on to state that this increase is not the result of consumers turning back to “normal” but rather the result of banks taking an active stance on building trust again. And this trust resides on customer experience.

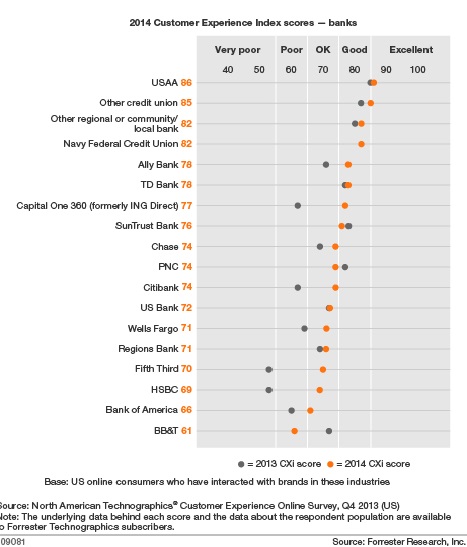

Now, the story gets a little more complicated and surprising – it’s not the banking conglomerates that rule the customer experience sector, in spite what you’d expect since they have the big bucks for solving every little problem. No, Forrester’s 2014 Customer Experience Index (CXi) shows that regional, local banks and community minded credit unions lead the pack with a “good” to “excellent” index score. Why is this so? Because being small and nimble allows you to break barriers, innovate and truly focus on customer needs. Just take a look at how Umpqua bank manages to topple the charts year after year in terms of customer experience and bank revenue growth.

Untangling what makes an excellent customer experience is a complicated task, but for now we’ll focus on 3 dimensions and how implementing an Unified Communications system can help banks score better on customer experience.

An Omni-channel Experience

Customers increasingly want to be able to interact with their banking facilities across the platform of their choosing, be it online, mobile, on the phone, the list goes on. By taking advantage of a sophisticated Unified Communications solution, banks can increase customer satisfaction by enabling customers to reach out to the institution across any device or platform at any time.

Unified Communications diminish the time a customer spends in a branch. For example, picture a client who moves one hour away from his regional bank and needs to transfer his account to a different branch of the bank. When he meets with his new banker during the transition, questions may arise about his financial history. With the right Unified Communications solution in place, the banker can gather all the pertinent data on this new client by conducting real-time instant messaging with a remote colleague who previously dealt with the client. After a speedy back-and-forth, numerous questions about the client’s history can be answered, enhancing productivity in the office. Enabling bankers to access colleagues through other methods apart from phone is very useful as bank officers are usually engaged with clients and are not able to take colleagues’ calls.

Take another example: with 4PSA’s VoipNow, for instance, customers can utilize the technology’s click-to-call feature to immediately reach their bank account manager by clicking a website link that dials instantly. With such a capability, if a customer notices an unwarranted charge on his banking statement, he can connect quickly and easily at any time and place using click-to-call to correct the banking error.

Better Personalization

Hand in hand with an omni-channel experience goes the personalization of experience, usually achieved through greater use of data and digital channels. Making digital content dynamic based on customer profile (showing him just the products or the information that might interest him) or enabling a smart queuing system (part of an Unified Communications suite) greatly help personalize the banking experience.

Enhanced Problem Resolution Experience

How a bank handles customer problems is of significant importance in determining the level of customer satisfaction. It is estimated that a customer who had a problem successfully and efficiently solved can become more of an advocate that a customer that never encountered a problem. Making it easy for customers to raise problems, correctly identifying the problem, solving it and following up for resolution are several ways to ensure first-call success. For example, VoipNow platform complex IVR allows callers to be identified instantly and connects them through to the last bank employee with whom they communicated. Additionally, through a simple integration with the bank’s CRM system, all the customer’s history pops up on the agent’s screen. This allows for faster resolution and diminishes the discomfort of constantly identifying the caller.

There are many other examples of how the financial services industry has become a major player in the Unified Communications market. In fact, finance, banking and insurance companies report greater than average uptake across most UC applications, including mobile UC where industry uptake rates are more than 10 percent above the global cross-industry average.

So, being nimble, customer focused and applying the latest technology in communications and collaboration is the way forward to winning back customers’ precious trust!

Post A Reply