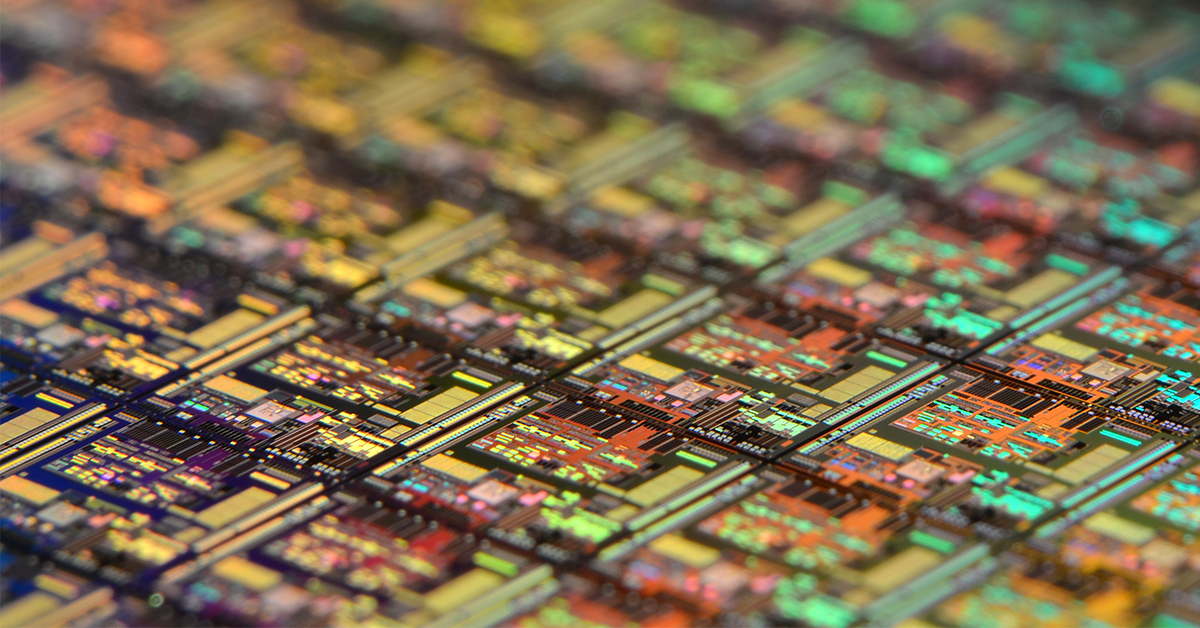

Photo by Laura Ockel on Unsplash

According to the PWC 2015 Global Digital IQ Survey, “digital” is creating significant disruption inside organizations everywhere, but not so much on the outside. Few companies are looking at tech investments with the same eyes, but those who see disruption power in digital have been attributed a “Digital IQ” that surpasses that of ordinary companies.

If technology does one thing right, it’s disruption. New technology means new capabilities, new inroads, new ways to reach the market or answer customer needs, faster ways to reach the market and customer needs, and so on, and so forth. A disruptive innovation helps create new markets and new value networks. Every time new tech comes along, it’s usually the early birds who gain a leading edge in that field and / or their respective industry. For example, Uber with their app-centric transportation business. Or 3D printing, drones, electronic cigarettes (vaping), etc.

But it’s not just about being the first to the game. Sometimes it’s a matter of harnessing existing resources more efficiently, such as Tesla with their highly-efficient electric cars. In any case, the best approach to giving your company a technological edge is to use that new technology for all it’s got. And today, that’s not happening.

Just 1% of executives expect digital disruption

PWC’s annual survey is a good indicator of how today’s executives perceive tech investments. According to the report, just 1% of the 2,000 executives in the survey said their number-one expectation for digital was to disrupt their own or other industries. Only when asked to rank the top-three ways they see value out of digital that number climbed to 8%.

45% said “growing revenue” was at the top of their agenda for digital, followed by “better customer experience” (25%) and “increasing profits” (12%). Of course, it’s not working out very well for many of them. Many fail to achieve targets, and only a few truly understand the potential of going all-in with digital, according to the research.

The outside-in approach

Impressions on the topic differ a lot among companies, especially between top performing and under-performing companies. The study shows how top-performers prefer an outside-in approach to innovation, leveraging other innovators’ knowledge base, in order to find new ideas for using technology and apply them.

The 8% of companies looking to disrupt industries have an even broader view of innovation and constantly seek opportunities to digitize their business. 71% of digital disruptors do this, compared with 63% of other companies.

Those seeking a competitive advantage through tech achieve market differentiation by actively engaging and learning from outside sources. Not every idea is good for any business, so management has the responsibility to filter and prioritize those technologies that promise the most value for the company.

Post A Reply